Medicare is complex, with lots of parts, costs and benefits, coverage options, and rules. HICAP can help you understand when to enroll, what your options are, how it all works, and what makes sense for you. There are some basic parts of Medicare as well as two main paths to getting coverage, as explained below.

Medicare is complex, with lots of parts, costs and benefits, coverage options, and rules. HICAP can help you understand when to enroll, what your options are, how it all works, and what makes sense for you. There are some basic parts of Medicare as well as two main paths to getting coverage, as explained below.

HICAP holds monthly Welcome to Medicare classes around the County. HICAP also offers free, confidential one-on-one counseling at sites throughout the county.

Help is also available on the Medicare website, www.medicare.gov, as well as in Medicare’s publication “Medicare & You.” You can download a copy of the “Medicare & You” handbook from the Medicare website. (Requires Acrobat Reader)

Medicare is health insurance for citizens or legal residents (typically green card holders who have lived here for the past five years) and are at least 65 years of age. It is also for those younger than 65 who have been on Social Security Disability (SSDI) for 25 months, or those with End Stage Renal Disease (ESRD) or ALS. Enrollment in Medicare is done through the Social Security Administration.

If you miss your Initial Enrollment Period you may be eligible for a Special Enrollment Period if you or your spouse are still working and have group insurance. (Be careful, the rules are complex!) Otherwise you can sign up during the General Enrollment Period during the first quarter of each year. In that case coverage begins the following July, and you may also be subject to a permanent late enrollment penalty. Enrollment rules can be complicated, and timing is very important. See HICAP before you turn 65! Learn more about the Part B late enrollment penalty.

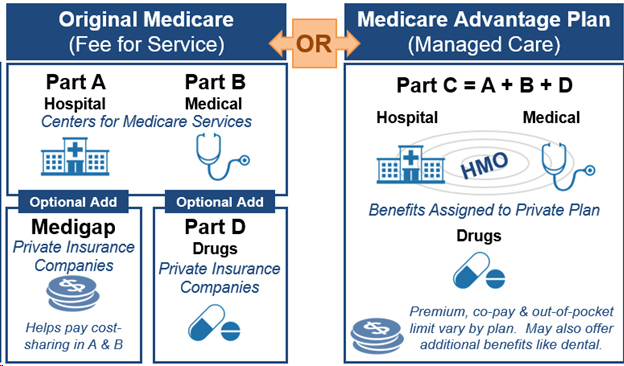

Medicare benefits are covered under 4 parts as shown below.

Medicare Basics

| PART A Hospital Insurance |

Inpatient hospital care Skilled nursing facility care Hospice care Home health care |

| PART B Medical Insurance |

Services from doctors Outpatient care (e.g., tests, procedures, some drugs, ambulance, ER) Home health care Durable medical equipment Many preventive services |

| PART D Prescription Drugs |

Cost of prescription drugs |

(NOTE: Part C is one of the two major ways to receive Medicare benefits, which will be covered below.)

Each part has its own premiums, coinsurance, and/or copayments . Your out-of-pocket costs and where you can get your care will depend on how you choose to get Medicare coverage.

The Two Paths of Medicare

A key decision you have to make when you start Medicare is how you want to get your coverage. There are two different paths, Original Medicare Parts A and B with optional Part D and an optional Medigap supplement (Fee for Service model), or Medicare Advantage (Managed Care model).

Under Original Medicare, Parts A and B are administered directly by the Center for Medicare and Medicaid Services (CMS). They operate under a Fee-for-Service care model. Part D, which is optional but recommended, conforms to standards set forth by CMS but is sold by private insurance companies. It can be purchased in conjunction with either Parts A or B through stand-alone prescription drug plans. Original Medicare can also be supplemented with private insurance plans or Medicare Supplements. These are usually called Medigap policies, since they are designed to pay the portion of covered medical costs not paid by Original Medicare (the gaps.) These policies help with deductibles and cost sharing that you’re otherwise responsible for paying under Parts A and B.

Alternatively, you can opt to receive your Medicare coverage another way, which is through Part C, more commonly known as Medicare Advantage plans. These are plans also sold by private insurance companies according to standards set forth by Medicare. These plans assume all responsibility for your medical care and follow a Managed Care model. They tend to be HMOs or PPOs. You must follow the plan’s rules and generally can’t use your Original Medicare card outside the plan’s network. Each Advantage plan has its own deductibles and copays. In order to join a Medicare Advantage Plan, you must have both Parts A and B of Medicare and pay the regular premiums for both, just like with Original Medicare. Learn more about the currently-available Medicare plans in Contra Costa County, including Medigap plans, Medicare Advantage Plans and stand-alone Prescription Drug plans under Part D.

You are generally locked into one path or the other for at least a year, with limited ability to change. Each option has pros and cons and it’s important to understand them before you decide. What is best for you depends on many factors such as your medical needs, expected usage and your financial situation.

If you have coverage through your employer, union, retiree plan or Veteran’s Administration you need to carefully understand how it works with Medicare. All plans are different. Some coordinate with Medicare and others don’t. Also, there are rules governing which coverage is primary and which is secondary depending on your employment status and the size of the employer. HICAP can help you understand the rules and analyze your options. HICAP Counseling locations.